Content

These are some aspects to consider in rental property accounting to deal with it properly. This will help to achieve better financial success in the rental property business. If you are just dipping your toes into real estate, it’s paramount that you get a solid understanding of how the tax system works. Learning it from the get-go will help you streamline the process and make sure you avoid hiccups later on. Installing an accounting system is the first step toward a successful real estate enterprise and will help you to make sure you get the maximum out of your investment. But what if you have never done accounting and need to learn the basics before setting up your books?

And to make invoicing your guests even easier, we also created beautifully designed, customizable templates that you can complete and send in just seconds. Finally, we investigated each company’s history in the market and their reputation for customer service and reliability. Stessa is perfect for landlords rental property bookkeeping and investors who want to manage their assets and track their finances by focusing on key metrics. However, it has a limited amount of features and is not fit for professional or enterprise-level users. Users can customize the features they use, making it suitable for any experience level.

A Simple Rental Property Accounting System for Small Landlords

This makes it easy to find and classify transactions while completing your tax prep or any day of the year. If you don’t want to clutter your workspace with tax forms, mortgage statements, maintenance bills, and other paperwork related to your real estate business, your best bet is good accounting software. These days, property management software helps to track a multitude of things, such as security deposits and vacancy reports, and set reminders for important dates, such as the tax-filing season. Rental income consists of rent payments, late rent fees, pet fees, termination fees, and appliance rental fees. Just as there are many different types of rental income, there are also many different types of expenses. Some of these expenses include repairs, routine maintenance, landscaping, utilities, marketing tools, property management fees, attorney fees, accountant fees, mortgage, property tax, and insurance.

Rental property bookkeeping doesn’t have to be a labor intensive task if you set things up right from the beginning. The basic accounting aspects remain similar for businesses of all categories. However, some considerations and the approach to accounting differ a lot. FreshBooks software also offers friendly customer service and excellent support when it comes to technical questions.

Rental Property Accounting Basics

Baselane rental property accounting software is designed to serve many types of real estate investors from small landlords to large property management companies. You may opt to use QuickBooks for rental property accounting but might be intrigued by the additional features rental software offers beyond just accounting tools. You’ll find that property management software comes with a whole range of features that will make each task of your rental business easier. From online rent collection to vacancy advertising, it’s all included in your rental software.

This builds a firm foundation to expand upon when you choose to get more advanced. Books without the paperwork mean an IRS auditor may never believe your claimed expenses. But if you have paperwork and no records, you’ll never have a clear, easy-to-understand summary of the financial happenings of your business. Before diving into the five steps to successful real estate accounting, let’s cover the basic terminology.

More Resources on Rental Property Accounting

Your CPA should be your north star as you run your rental business and prepare for tax season — but you need the right sidekick to streamline your bookkeeping and maintain compliance year-round. With Azibo, you’ll have access to all the tools you need to provide accurate financial data and reports to your CPA, while saving time and maximizing your tax benefits. To create a chart of accounts, you can go with something as basic as an Excel spreadsheet, or you can upgrade to a property management accounting software solution to help you put it together. Buildium, for example, creates a chart of accounts automatically, with entries that are customized for property managers. Another important step in setting up a rental property accounting system is choosing which method of accounting to use.

- By using a separate bank account or credit card for your rental property, you’ll always know which expenses are business related.

- Unless managing your rental properties is your full time job, you probably don’t have time to be tied to desk troubleshooting your accounting software all day long.

- Smoothly getting up and running is great, but over time you’ll want your accounting system to begin doing the work for you.

- Landlord Studio is a property management and accounting solution designed to make your rental property bookkeeping as easy as possible.

- The most popular way is called the “cash-basis method,” and it requires you to report income as soon as you receive it and report expenses when you pay them.

- Depending on the size of your property and the number of tenants that you have, running a real estate rental could amount to a full-time job.

- Avery has sold over $300 million in Short Term/Vacation Rentals since 2017.

Rental bookkeeping software creates a custom chart of accounts in a single click. Baselane captures every line item with bookkeeping software for rental property management so you can focus on expanding your portfolio. Make rental property management easier with our automated accounting software that saves time and money. You’ll use Form 1040 for your individual income tax return, but you’ll also need to report income and expenses for your rental properties. The form you’ll use to do this will depend on whether your rental properties are considered personal or real estate property rentals.

What Does Rental Property Bookkeeping Track?

According to FreshBooks’ website, utilizing the software saves an average of 16 hours every month. It offers some of the most detailed and comprehensive reporting features on this list too. In addition to its basic pricing tier, Rentec Direct offers a tenant screening add-on for between $7 per month with its Basic Screening Package and $15 for the Premium Screening Package.

But without invoice and receipts management, that is difficult to achieve. But what is the difference between an invoice and a receipt in accounting terms? You can try FreshBooks for free and use their many resources to learn everything you need about bookkeeping for property management. It’s one of the most accurate accounting systems which offers excellent long-term results.

Is rental income passive income?

There must be proper demarcation with your personal finances and business finances. However, even after you scan everything, it’s a good idea to back things up and keep a few folders with regular receipts and other paper records. Digital programs – including accounting software – could crash, leaving you scrambling to recover your data. Before you get started, let’s talk about the foundation of bookkeeping.

- This oversight costs many dollars and creates unnecessary and exhausting work.

- Doing so will help you stay up to date, make it easy to pick up where you last left off, and ensure that you never miss a deduction.

- So, properties, units, and sub-portfolios are supported out of the box without any special setup or accounting knowledge.

- This is the easiest way to keep your funds separate from your personal accounts until you are ready to pay yourself.

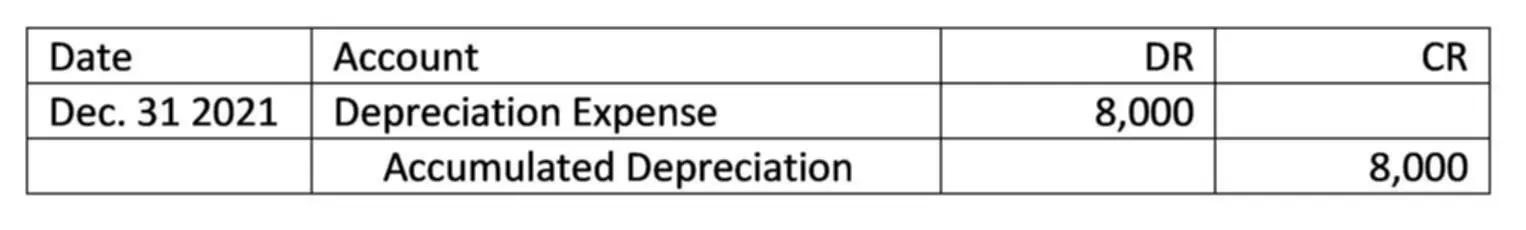

With this practice, every transaction is entered twice, once as a debit and once as a credit. Efficient bookkeeping for rental properties will help you generate profit and reap the most tax benefits. It should go without saying, but seek out a tax professional with expertise in real estate investing; that will reduce the chances you’ll accidentally underpay or overpay your taxes. Digitization will help you declutter your office, stay on top of your invoicing and even contribute to saving the planet.

Prepare for Tax Season

That’s because the buck stops with you, and not your CPA or accountant. Next, it’s time to choose a bookkeeping method; either single-entry or double-entry. In single-entry, all financial items, both incoming and outgoing, are entered just once. Having the right tools in place can help you manage finances for a rental property.

- With everything in one place, you’ll stay organized and will no longer have to track down a year’s worth of transactions come tax season.

- This streamlines the whole tenant rent payment process to one step that takes around 30 seconds.

- The expense of property improvements has to be capitalized and depreciated over several years instead of deducted in the year paid.

- These are important to have, but you do have the flexibility to tailor your chart of accounts to the needs of your business.

- Real estate investors use rental property accounting to track property financial performance at the property and portfolio level.

Consulting specialized professionals in areas outside your expertise is the only surefire way to safeguard your business. They will also serve as your guide when preparing and filing your taxes. When you set up your books (you can do this in excel or with the help of software like Quickbooks) you want to do it right the first time. This means creating expense categories to line up with your tax requirements as well as formatting everything so you can gain quick insights into finances and make informed decisions to increase profitability.